Lead

Lead, chemical symbol Pb (abbreviation from the Latin word Plumbum), is a rare, soft, dense metal which has been used by humans for many things over more than 2,000 years. By far the largest use for lead in contemporary times is in lead-acid batteries used in vehicles and other stationary energy storage applications.

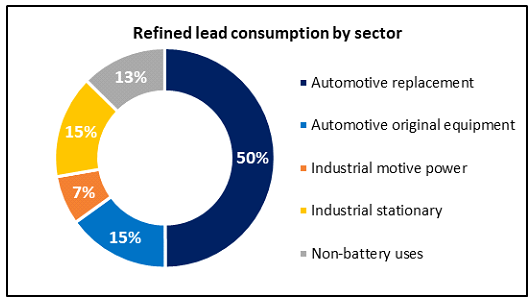

Globally over 400 million lead-acid batteries are produced each year. In Australia 8.5 million lead-acid battery sales were recorded in 2018. Worldwide, 87% of refined lead produced is used in batteries, including 50% in replacement batteries for vehicles. In the beginning of 2022, it was estimated that 1.4 billion vehicles exist in the world, which equates to a vehicle for every seven people worldwide. Every vehicle, including the vast majority (nearly all) of EV’s require lead-acid batteries.

So, why do electric cars have lead-acid batteries?

All cars, including electric cars, have 12V systems powering everything from windows, headlights, entertainment systems, the electronic supervision system/computers, air conditioning & heating. These systems have been developed over a long period of time and many standardised parts are available to car manufacturers. So, many of the 12V systems have carried over into electric vehicles whose battery packs produce much higher voltages. Additionally, as for internal combustion engines where the 12V system provides starting power to turn the engine over, in electric cars, it provides the essential task of controlling and managing the main battery pack. Specifically, given the large amount of power delivered from the main battery pack, safety requirements dictate that the system must physically connect and disconnect the main battery from the car’s driving systems. This minimises the chances of potentially hazardous electrical faults occurring, as well as ensuring that there is no ongoing power drain when the vehicle is not in use that could leave you with a flat battery pack.

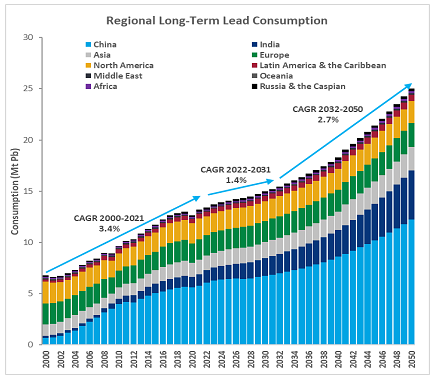

Worldwide, an increasing demand for motor vehicles exists as countries undergoing economic development and growth in the use of renewable energy sources with the need for storage batteries being directly proportional to the increasing demand for lead-acid batteries.

The advent of hybrid and electric vehicles will initially benefit the lead-acid battery market, but it will ultimately challenge the lead-acid battery use in its major use application. The lead-acid battery industry will continue to be relevant over time on the basis that “hybrid” technology will also deliver 70% of the benefits to emissions reductions for 30% of the cost. The ongoing development of advanced types of lead-acid batteries using specialised carbon additions or bipolar designs will also enhance the hybrid technology and market options.

One area for significant growth is being seen with the advent of increasing numbers of stop-start vehicles. Batteries in stop-start vehicles require up to an additional 25% lead per battery to cater for the continuous stopping and re starting of the vehicle.

The push for more vehicles in the developing counties of the world and the evolution of EV’s will be offset by the cost and the requirement of any supporting infrastructure. Battery Energy Storage Systems (BESS) are a growing industry for balancing renewable energy generation from solar, wind and other improving technologies. Large stationary lead-acid storage systems are being installed based on significant cost savings and reliability factors. BESS are typically located between the grid and the end use. They enable a reliable and effective reduction to higher power costs during peak periods.

13% of the worlds refined lead production is used for non-battery uses. Sheet lead is used for sound deadening in construction walls and floors. Radiation shielding, electronic connections and sheathing, ballast and weights, car wheel balancing, ceramic glazes, and glass optics, fishing sinkers and projectiles. Lead is widely used for a wide range of industrial purposes. Highly ductile, corrosion resistant, high specific gravity and limited cost competitive alternatives underpin many safe and non-toxic applications. The ongoing elimination of lead-bearing fumes from gasoline and lead based paint is strongly encouraged and this will see a dramatic improvement in lead related health concerns world-wide.

In the June 2022 commodity market report compiled by Wood Mackenzie, the demand for lead has shown strong resilience to the global pandemic and the war in Ukraine with steady growth forecast at 1.6% for this year. Lead consumption last year exceeded pre pandemic levels exceeding 13 million tonnes for the first time. This demand growth is forecast to be at 1.4% pa over the next 10 years. The growth has been driven by strong demand in the developing regions of South-East Asia, China and India.

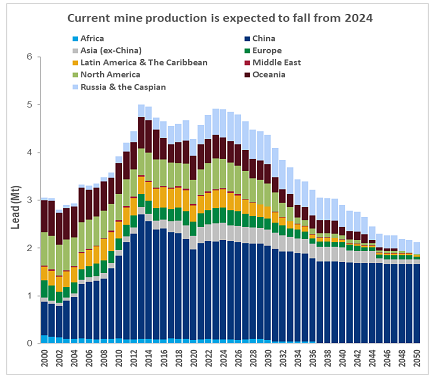

The global Covid-19 pandemic has affected mine supply more than lead consumption. Mine production is still short of the pre pandemic production seen in 2019. Wood Mackenzie forecast modest increases in mine lead production over the next 5 years. After 2024 a reduction in global mine production is forecast on the back of diminishing resources. The timing of the delivery of the Abra project in a “tier 1” mining location and the quality of the concentrate that will be produced present a very positive outlook.

A high recycling rate and globally established infrastructure has been in place for some time to recycle lead. Around 50% of all lead products contain recycled lead. Cost and environmental advantages in recycling lead have also been a significant positive factor for the ongoing use of lead.

The resilience of the lead market is underpinned by the requirement for replacement vehicle batteries. Due to the steady demand profile and the high level of recycling, the price of lead exhibits less volatility than many other metals, and over the past 5 years has generally traded in a range between US$0.80-1.10/lb. This makes it somewhat less exciting than some metals which experience irregular but very large price fluctuations, but the corollary is that producers such as Abra can have more confidence in their long-term production and outlook.